Table of Contents[Hide][Show]

- What to Do If Prudential Denied or Terminated Your LTD Claim

- The Real Odds of Facing Long-Term Disability

- How Prudential Long-Term Disability Claims Are Evaluated

- Why Prudential Denies Long-Term Disability Claims

- How Prudential Uses Surveillance and Social Media

- Recognizing Bad Faith in Prudential Disability Claims

- What to Do After a Prudential LTD Denial

- How ERISA Affects Prudential Disability Claims

- What If ERISA Does Not Apply?

- How to Appeal a Prudential Long-Term Disability Denial

- Additional Evidence That Can Strengthen Your Appeal

- Filing a Lawsuit Against Prudential

- How an Attorney Can Help with a Prudential LTD Denial

- About the Ortiz Law Firm

- Prudential Disability Case Results

- Get a Free Case Review

What to Do If Prudential Denied or Terminated Your LTD Claim

The Prudential Insurance Company of America is one of the largest providers of group long-term disability (LTD) insurance in the United States. As a subsidiary of Prudential Financial, the company administers disability claims for employers nationwide. Unfortunately, size and resources do not always translate into fair claim handling.

Many claimants find that Prudential prioritizes policy interpretations and cost containment over a fair evaluation of medical evidence. When a legitimate long-term disability claim is denied or terminated, the financial and emotional impact can be devastating.

If Prudential has denied your LTD claim, it is critical to understand why the decision was made and what steps you can take next to protect your benefits.

The Real Odds of Facing Long-Term Disability

Many people underestimate how common long-term disability really is. According to data from the Social Security Administration, roughly one in four workers will experience a disability lasting at least a year before reaching retirement age.

Long-term disability does not only result from catastrophic accidents. Chronic illnesses, progressive conditions, mental health disorders, and complications from common medical issues frequently prevent people from sustaining full-time work. This is precisely why disability insurance exists—and why denials can be so disruptive when benefits are needed most.

How Prudential Long-Term Disability Claims Are Evaluated

Prudential acts as both the administrator and, in many cases, the payer of long-term disability benefits. When reviewing a claim, Prudential may:

- Review medical records and treatment notes

- Obtain file reviews from in-house or contracted physicians

- Conduct interviews with claimants

- Order surveillance or review social media activity

Although insurers frame this process as objective, claim decisions often rely heavily on paper reviews and policy interpretations that favor denial.

Why Prudential Denies Long-Term Disability Claims

Understanding the stated reason for denial is the foundation of any successful appeal. Prudential commonly denies LTD claims for reasons such as:

- Alleged insufficient medical evidence

- Claims of “lack of objective findings”

- Failure to meet the policy’s definition of disability

- Incomplete or inconsistent claim forms

- Disagreement from peer review physicians

- Surveillance or social media activity

- Pre-existing condition exclusions

- Policy-specific exclusions

Even when claimants submit medical support, Prudential frequently relies on internal reviewers who have never examined the claimant and who may discount treating physician opinions.

Policy Provisions Prudential Uses to Deny Claims

The Definition of Disability

Most Prudential LTD policies use a two-stage definition of disability. Initially, benefits may be paid if the claimant cannot perform the material duties of their own occupation. After a defined period—often 24 months—the definition shifts to whether the claimant can perform any occupation.

Many denials and terminations occur at this transition, even when the claimant’s medical condition has not improved. Prudential may rely on vocational reviews or theoretical job matches that do not reflect real-world work demands.

Pre-Existing Condition and Policy Exclusions

Prudential policies often contain exclusions for pre-existing conditions or specific diagnoses. These provisions are sometimes applied broadly, tying a disabling condition to earlier symptoms or treatment that are only marginally related.

When exclusions are misapplied, they can often be challenged through careful analysis of medical records and policy language.

How Prudential Uses Surveillance and Social Media

Prudential may hire investigators to observe claimants or review online activity. Isolated moments—such as running an errand or attending a family event—are sometimes used to argue that a claimant is capable of working.

These snapshots rarely reflect the full impact of pain, fatigue, symptom variability, or recovery time, but they are frequently cited in denial and termination letters.

Recognizing Bad Faith in Prudential Disability Claims

Insurance companies are required to act in good faith and fairly evaluate claims. When Prudential denies a valid claim without reasonable justification, delays decisions unnecessarily, or ignores supporting evidence, it may be acting in bad faith.

However, for most employer-sponsored disability plans, ERISA limits the remedies available to claimants. This makes the administrative appeal stage especially important.

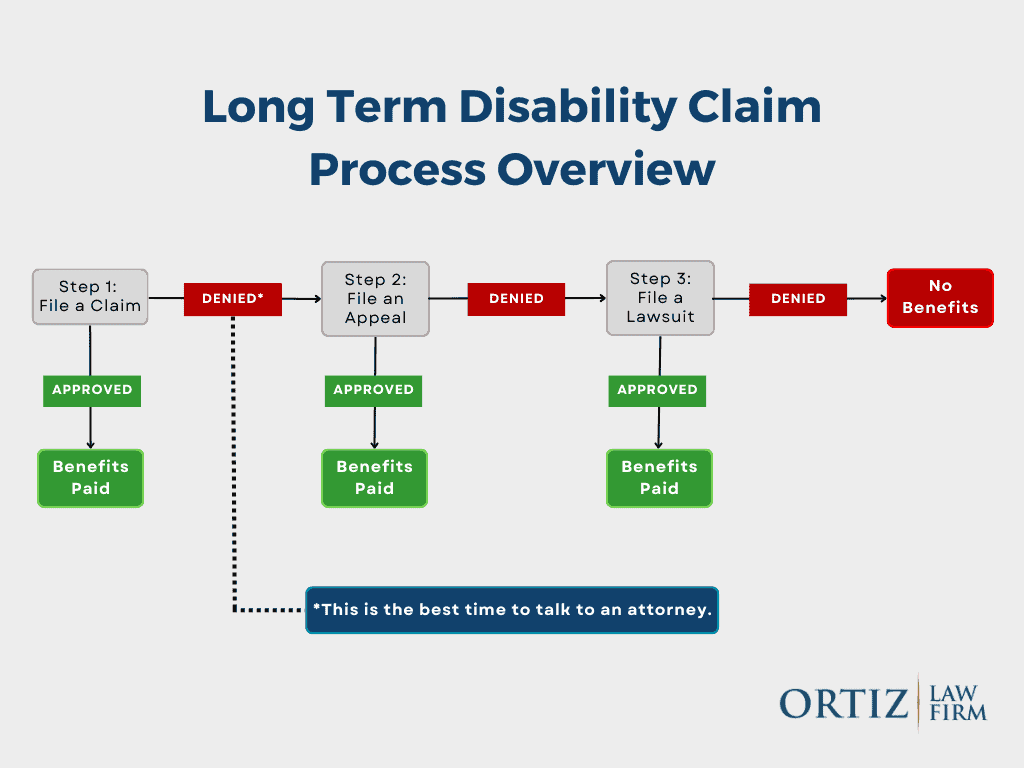

What to Do After a Prudential LTD Denial

A denial does not mean the end of your claim—but deadlines matter.

After receiving a denial letter, you should:

- Carefully review the stated reasons for denial

- Request a complete copy of your claim file

- Obtain the full disability policy

- Calendar all appeal deadlines

- Begin gathering updated medical evidence

Missteps at this stage can permanently limit your ability to challenge the denial.

How ERISA Affects Prudential Disability Claims

Most Prudential group disability policies are governed by the Employee Retirement Income Security Act (ERISA). ERISA imposes strict deadlines and procedures that must be followed before a lawsuit can be filed.

Under ERISA:

- Claimants usually have 180 days to file an appeal

- All evidence must be submitted during the appeal stage

- Courts generally review only the administrative record

Because evidence cannot usually be added later, the appeal process is often the most critical phase of the claim.

What If ERISA Does Not Apply?

Individual disability policies, as well as policies provided by certain government or church employers, may not be governed by ERISA. These claims are typically controlled by state law and may allow litigation without exhausting administrative appeals.

Determining whether ERISA applies is a key early step in evaluating your options.

How to Appeal a Prudential Long-Term Disability Denial

A strong appeal directly addresses Prudential’s stated reasons for denial and fills gaps in the claim file. Successful appeals often include:

- Detailed medical opinions from treating providers

- Clarification of functional limitations

- Vocational evidence addressing job demands

- Written statements explaining symptom impact

If ERISA applies, this may be your only opportunity to submit additional evidence.

Additional Evidence That Can Strengthen Your Appeal

Depending on the denial reason, helpful evidence may include:

- Updated medical examinations or specialist evaluations

- Narrative reports from treating physicians

- Vocational expert opinions

- Statements from family members or coworkers

Coordinating this evidence effectively is often key to overturning a denial.

Filing a Lawsuit Against Prudential

If administrative appeals are exhausted, you may be able to file a lawsuit in federal court. Prudential’s exhaustion letters typically state that no further internal review will occur and outline litigation deadlines.

Federal courts generally do not consider new evidence, which is why careful appeal preparation is essential.

How an Attorney Can Help with a Prudential LTD Denial

An experienced disability attorney can:

- Identify weaknesses in Prudential’s reasoning

- Ensure appeal deadlines are met

- Develop medical and vocational evidence

- Handle communications with the insurer

- Prepare the claim for potential litigation

Legal representation helps level the playing field against a well-resourced insurer.

About the Ortiz Law Firm

The Ortiz Law Firm is a national disability law firm based in Pensacola, Florida. Led by disability attorney Nick Ortiz, the firm represents individuals nationwide in long-term disability appeals and lawsuits.

We operate under a No Recovery, Zero Fee Guarantee. You pay no legal fees unless benefits are recovered.

Prudential Disability Case Results

We have successfully resolved many Prudential LTD claims, including:

- Benefits approved despite reliance on self-reported symptoms

- Claims overturned despite reliance on peer reviews

- Mental health and chronic condition claims reinstated

Names are withheld to protect client privacy.

Get a Free Case Review

Don’t let Prudential’s denial prevent you from receiving your rightful benefits. Take action today to protect your financial stability and secure the compensation you deserve.