On This Page[Hide][Show]

It can be challenging to navigate the lengthy appeal process following a long-term disability claim denial from The Standard Insurance Company. The Standard Insurance Company is known for its rigorous review process, so claimants need to be prepared when filing an appeal.

Understanding the appeal process and your rights can greatly increase your chances of a successful outcome. If The Standard has denied your long-term disability benefits, a national long-term disability attorney at the Ortiz Law Firm can review your denial letter for free and develop an appeal strategy to get your benefits back. Call us at (888) 321-8131 or contact us through our website to begin your free case review.

What Type of Disability Insurance Does The Standard Offer?

The Standard Insurance Company offers two types of disability insurance to meet different needs. The Standard’s short-term disability insurance is designed to provide temporary income replacement if you are unable to work due to a covered illness or injury. This type of insurance typically covers a portion of your salary for a specified period of time, usually up to six months.

Long-term disability insurance, on the other hand, provides extended coverage for disabilities that prevent you from working for an extended period of time, usually after short-term disability benefits have ended. Standard long-term disability insurance can provide years of financial protection, ensuring that you have income security during extended periods of disability.

Most people get disability insurance as part of a group benefit plan through an employer. The Employee Retirement Income Security Act (ERISA) governs group policies. Alternatively, individually purchased policies are governed by state insurance laws.

Disability policies vary widely, from how they define disability to the conditions they cover. Some policies pay benefits if you can’t do your specific job, while others pay benefits only if you can’t work at all. A skilled long-term disability attorney can review your policy and explain your rights.

Understanding Why The Standard Denies Long-Term Disability Claims

Understanding why The Standard Insurance Company may deny a long-term disability claim is crucial for individuals navigating the claims process. Here are common reasons why your claim may be denied.

You Do Not Meet the Definition of Disability

You may be denied because The Standard determines that your condition does not meet Standard’s specific definition of disability. It is important to carefully review your policy’s terms and conditions to ensure that your condition meets the insurance company’s criteria.

Insufficient Medical Evidence

Another common reason for denial is when there is a lack of comprehensive medical evidence to support your disability claim. This means that the insurer does not believe that your medical problems are severe enough to prevent you from working. However, the insurance company may not have all of your medical records.

And even if you have evidence from your doctors, you could still face a claim denial. Your doctors may mistakenly fill out your forms in a way that results in an unfairly denied claim. It may be up to you to ensure that the information from your healthcare providers is thorough and accurate to establish the severity and limitations of your condition.

Policy Exclusions and Limited Benefit Periods

Review your policy carefully before submitting a claim. The fine print in your plan document may affect your eligibility for disability insurance benefits. Some disabilities are limited or excluded from coverage altogether.

Denials may also occur if your disability falls under a policy exclusion or you have reached the limit of your benefit period. Understanding the specifics of your policy can help you anticipate and address potential issues that could lead to a denial.

Pre-Existing Condition Exclusions

There are typically pre-existing condition exclusions. Here is an example from a Standard disability insurance policy:

“1. Pre-existing Condition means a mental or physical condition whether or not diagnosed or misdiagnosed:

- For which you have done or for which a reasonably prudent person would have done any of the following

- Consulted a physician or other licensed medical professional;

- Received medical treatment, services, or advice;

- Undergone diagnostic procedures, including self-administered procedures;

- Taken prescribed drugs or medications;

- Which, as a result of any medical examination, including routine examination, was discovered or suspected;

at any time during the 90 days just before your insurance becomes effective.

2. You are not covered for a Disability caused or contributed to by a Pre-existing Condition or medical or surgical treatment of a Pre-existing Condition unless, on the date you become Disabled, you:

Standard Long-Term Disability policy

- Have been continuously insured under the Group Policy for 12 months; and

- Have been Actively At Work for at least one full day after the end of that 12 months.”

Mental Disorders and Substance Abuse

Exclusions for mental disorders or conditions related to substance abuse are also common. Here is an example from a Standard disability insurance policy:

“Payment of LTD Benefits is limited to 24 months during your entire lifetime for a Disability caused or contributed to by any one or more of the following, or medical or surgical treatment of one or more of the following:

- Mental Disorders; or

- Substance Abuse.

Mental disorder means any mental, emotional, behavioral, psychological, personality, cognitive, mood, or stress-related abnormality, disorder, disturbance, dysfunction, or syndrome, regardless of cause (including any biological or biochemical disorder or imbalance of the brain) or the presence of physical symptoms.

If you are confined in a Hospital solely because of a Mental Disorder at the end of the 24 months, this limitation will not apply while you are continuously confined.

Substance Abuse means use of alcohol, alcoholism, use of any drug, including hallucinogens, or drug addiction.

Standard Long-Term Disability policy

- If you are Disabled as a result of a Mental Disorder or any Physical Disease or Injury for which payment of LTD Benefits is subject to a limited pay period, and at the same time are Disabled as a result of a Physical Disease, Injury, or Pregnancy that is not subject to such limitation, LTD Benefits will be payable first for conditions that are subject to the limitation.

- No LTD Benefits will be payable after the end of the limited pay period unless on that date you continue to be disabled as a result of a Physical Disease, Injury, or Pregnancy for which payment of LTD Benefits is not limited.”

An Expert Hired By Standard Has Determined That You Are Not Disabled

The Standard Insurance Company may use the opinion of its medical or vocational experts to evaluate your disability claim. The Standard uses vocational evaluations, paper file reviews, and in-person medical examinations to break down cases involving a variety of medical conditions. If these experts determine that you are not disabled based on their evaluations, your claim may be denied.

In such cases, you may be able to get a second opinion or appeal their findings may be an option. Your denial letter may state, “Based on your medical records and the physician consultant’s review, it is determined that you do not meet the group policy definition of disability,” or “Your condition does not cause sufficient limitations to prevent you from working.”

Video or Social Media Surveillance

It’s not uncommon for insurance companies like The Standard to conduct surveillance, including observing your social media activity and recording videos of your daily life. Inconsistencies between your reported limitations and observed behavior may result in a denial of your claim.

In many of our cases, the insurance company does not give claimants the benefit of the doubt. They may say that your activities on video are inconsistent with your claim. Despite all the evidence, the insurance company will question the credibility of your claim.

How to Appeal a Standard Long-Term Disability Denial

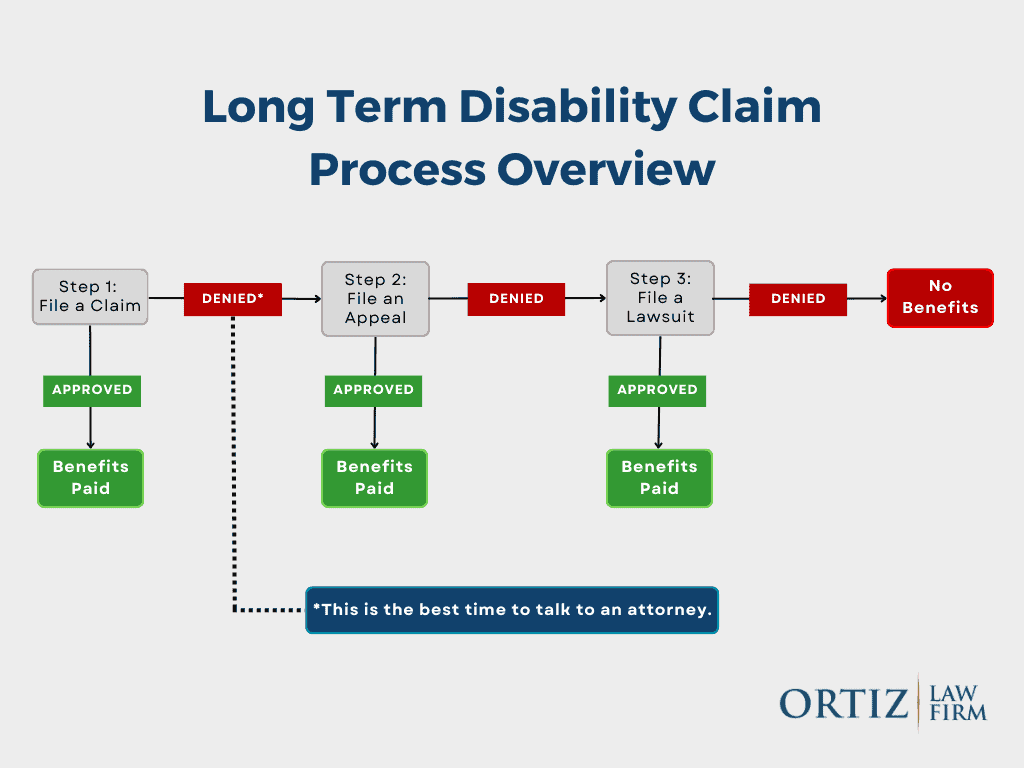

After receiving a denial letter for your long-term disability claim from The Standard, it is important to take immediate action to appeal the decision. Here are the essential steps to guide you through the appeal process:

First Steps

When faced with a denial, begin by carefully reviewing the denial letter. Understand the reasons for the decision and the deadline for filing an appeal. Notify your employer and request a copy of your benefit plan and policy from The Standard to better understand your coverage and rights.

Gathering Evidence

Gathering relevant evidence is critical to a successful appeal. Focus on developing the weaker parts of your claim. You need to gather strong evidence to challenge the denial and support your claim. Get copies of all your medical records, test results, and any documents that support your disability claim.

It is also helpful to gather statements from healthcare providers, co-workers, and family members documenting how your condition affects your daily life and ability to work. Having a disability insurance professional guide you through the appeal process may also improve your chances of approval.

Write an Effective Appeal Letter

Writing a strong appeal letter is essential to presenting your case convincingly. Address each reason for the denial and provide additional medical evidence and explanations to address the concerns raised by The Standard. Be concise and factual, and emphasize the impact of your disability on your ability to work.

RELATED POST: LTD Appeal Guide: How to Appeal a Long-Term Disability Denial

Understand The Standard’s Appeals Review Process

Familiarize yourself with The Standard’s appeal review process so you know what to expect. The insurance company will usually reevaluate your claim, consider new evidence, and decide on your appeal. A claims representative may ask you for more information about your symptoms, limitations, and daily activities.

The insurer may also request information about personal injury or Social Security Disability Insurance claims. Be prepared for possible delays and be persistent in tracking the progress of your appeal.

Communicating with The Standard’s Representatives

Maintaining open and transparent communication with The Standard’s representatives is critical throughout the appeals process. Keep detailed records of all conversations, emails, and documents exchanged. Be proactive in providing any additional information requested in a timely and professional manner.

Navigating a long-term disability appeal can be challenging, but being well prepared and strategic in your approach can increase your chances of a successful outcome. Stay organized, seek legal advice when necessary, and advocate for your rights throughout the appeals process.

How to File a Disability Lawsuit Against The Standard

When filing a disability lawsuit against The Standard, there are different options to consider depending on the type of policy you hold. Understanding the process and your rights can be crucial in navigating this complex legal process.

ERISA LTD Claims

If you have a long-term disability (LTD) insurance policy through your employer, it is likely covered under the Employee Retirement Income Security Act (ERISA). Filing a lawsuit under ERISA involves a structured process that begins with appealing the denial of your disability claim directly to The Standard.

To file a lawsuit under ERISA, you must exhaust all administrative remedies, which means going through The Standard’s internal appeals process. This typically involves submitting additional documentation, providing medical evidence, and presenting your case to The Standard’s review panel. If your appeal is denied, you may file a lawsuit in federal court.

Under ERISA law, federal courts cannot consider new evidence or updated medical records submitted during the case proceedings. Federal courts can only review documents that are already in the claim file. You must submit all the relevant evidence during the administrative appeal process.

Federal Court Case Summaries

Individual Disability Insurance Claims

For those with independently purchased individual disability insurance policies, the process for filing a lawsuit may differ from ERISA claims. Individual policies are not subject to ERISA regulations, which may affect the process for appealing a denial with The Standard.

If The Standard denies your individual disability insurance claim, you may be able to file a lawsuit directly without exhausting internal appeals. However, this does not mean that it would be beneficial for you to skip the appeals process. Consulting with an attorney who specializes in disability insurance law can help you understand the pros and cons of appealing your denial, as well as the specific steps and legal requirements for pursuing a lawsuit against The Standard in this scenario.

Navigating the process of filing a disability lawsuit against The Standard requires attention to detail, persistence, and a thorough understanding of the terms and conditions of your policy. Seeking legal advice and assistance can greatly increase your chances of successfully challenging a denial and obtaining the disability benefits you deserve.

How the Ortiz Law Firm Can Help

The Ortiz Law Firm is dedicated to assisting individuals who have faced long-term disability denials and appeals with The Standard Insurance Company. Here’s how the firm can help you navigate through this challenging process:

Experienced Legal Representation

The Ortiz Law Firm specializes in handling disability insurance claim denials and appeals. Nick Ortiz is an experienced disability attorney who has been handling The Standard’s wrongful claim denials since 2005. With years of experience in the field, our legal team has in-depth knowledge of the laws and regulations surrounding long-term disability claims, ensuring that you have expert representation on your side.

Personalized Case Evaluation

When you contact the Ortiz Law Firm, we will thoroughly review your case to understand the specifics of your situation. This personalized approach allows us to tailor our appeal strategies to best meet your needs best and increase your chances of a successful appeal.

Navigating the Appeals Process

Navigating the appeals process can be overwhelming, but the Ortiz Law Firm will guide you through each step. The effort and attention to detail required to win an administrative appeal is much more extensive than most claimants realize. From gathering the necessary documentation to preparing legal arguments on your behalf, we will work diligently to present a compelling case for overturning your denial.

Effective Communication

Communication is essential in any legal matter, and we prioritize keeping our clients informed and involved throughout the appeals process. You can rely on our team to provide clear updates, promptly answer your questions, and address your concerns.

Proven Track Record of Success

The Ortiz Law Firm has a proven track record of helping clients secure the long-term disability benefits they deserve. Their dedication to client advocacy and commitment to achieving positive outcomes sets them apart as a trusted and reliable partner in your fight for justice.

Ortiz Law handled the appeal with my insurance company efficiently and professionally. The paralegal in charge of my case, Tory, answered any questions I had quickly, provided guidance on addressing inquiries from the insurance company during the course of the appeal, and always followed up with the insurance company in a timely manner. I highly recommend this firm!

Get Help with Your Standard Disability Denial

By choosing the Ortiz Law Firm to help you with your long-term disability denial and appeal with The Standard Insurance Company, you can benefit from our expertise, personalized approach, and unwavering support during this difficult time. You only have a limited amount of time to appeal, so contact us as soon as possible. Call (888) 321-8131 for a free case evaluation.

Frequently Asked Questions

What are the top reasons for The Standard’s long-term disability denials?

The primary reasons for The Standard’s long-term disability denials typically include insufficient medical evidence, missed deadlines, failure to meet the policy’s definition of disability, damaging evidence developed by the insurance carrier, and policy exclusions or limitations for certain conditions.

How do I appeal a long-term disability denial from The Standard Insurance Company?

To appeal a long-term disability denial from The Standard Insurance Company, you must gather all relevant medical records, documentation, and additional information supporting your claim. Submit a written appeal letter explaining why you believe the denial was incorrect and include any new evidence to strengthen your case.

Is there a deadline for appealing a denial of long-term disability benefits from The Standard?

Yes, there is usually a time limit for appealing a long-term disability denial by The Standard. Typically, you only have 180 days to appeal your long-term disability claim. However, some policies have shorter deadlines, such as 60 or 90 days. The deadline is firm. Even if you ask, The Standard doesn’t have to give you more time. If you miss this deadline for your appeal, you may not be able to proceed with your claim.

How much does it cost to hire a long-term disability attorney?

Most lawyers who handle long-term disability cases only get paid if your claim is approved. You don’t have to pay anything up front. If your claim is approved, their fee will be a percentage of the benefits you receive from The Standard, as outlined in your agreement with them. At the Ortiz Law Firm, we never charge a fee unless your case results in compensation.

How can I improve my chances of a successful long-term disability appeal with The Standard Insurance Company?

To improve your chances of a successful long-term disability appeal with The Standard Insurance Company, provide thorough and accurate documentation to support your claim. Working with an attorney who understands disability law can also increase the likelihood of a favorable outcome.

What happens if my long-term disability appeal with The Standard Insurance Company is denied?

If your long-term disability appeal with The Standard Insurance Company is denied, you may have the option of filing a second appeal or lawsuit against the insurance company. Consulting with an attorney who specializes in disability law can help you explore these options and determine the best course of action.