On This Page[Hide][Show]

Applying for Long-Term Disability Benefits+−

- Step 1: Request a Copy of Your Long-Term Disability Policy and Application

- Step 2: Complete the Employee Statement Portion of the Application

- Step 3: Obtain an Employer Statement

- Step 4: Obtain Statements From Your Physicians

- Step 5: Submit Additional Supporting Documents

- Step 6: Review and Double-Check Your Application and Supporting Documentation

- Step 7: Copy and Organize

- Step 8: Bring a Claim to the Plan Administrator

- The Determination Process for Long-Term Disability Claims

- Request a Free Case Evaluation with a Long Term Disability Lawyer

After you have exhausted your short-term disability benefits (usually a requirement), you can apply for long-term disability (LTD) benefits. Knowing how the process will work before you apply is helpful. In this article, we walk you through the long-term disability process from application to award.

Applying for Long-Term Disability Benefits

Step 1: Request a Copy of Your Long-Term Disability Policy and Application

Usually, the human resources department can provide this with no problem. If they cannot, you must request it in writing and send your request by certified mail. They must provide you with this information, and their failure to do so promptly can help your claim.

NOTE: You may also find the application on the insurance company’s website. Just be mindful when searching for it; download the most recent application.

Step 2: Complete the Employee Statement Portion of the Application

You will complete this portion with essential information like name, date of birth, address, family members, date of injury, the last date you worked, etc. You will also need to list your reason for applying for disability, the medical providers treating you, your treatment plans, your medications, and any other form of income that you receive.

You will notice immediately that the form has limited space. The insurance company intentionally does this to deter you from providing everything you want so they can easily deny your claim. Just write or type out your responses on a separate document. Later, you’ll save a copy for your records and submit a copy with your application.

Step 3: Obtain an Employer Statement

Your employer will also need to provide information to the insurance company. Typically, your employer will provide your hire date, last date you worked, earnings history, and physical and mental job requirements. Your human resources department or your payroll and benefits department can complete this.

Step 4: Obtain Statements From Your Physicians

The insurance company will require a statement from your treating physicians. They will request information such as when you were diagnosed, your symptoms and pain levels, lab results, limitations and restrictions, surgeries, and hospitalizations. If you receive treatment from multiple physicians for different conditions, obtain a statement from each physician.

We recommend that you make an appointment with your doctor and have them fill out a residual functional capacity (RFC) form while you are present. It is common for doctor’s offices to misplace paperwork or not treat it as a priority. This could delay your claim or even cause you to miss a deadline, which can cause an automatic denial. Most doctor’s offices will charge you a fee to complete this paperwork. It is totally within each doctor’s discretion (a) whether to charge a fee and (b) how much to charge.

Step 5: Submit Additional Supporting Documents

A common mistake is assuming the insurance company will gather all the medical information. While they will gather some of your medical records, there is no guarantee that they will collect all the evidence necessary to support your claim. If you have documents that will help your claim, submit them. Just make sure anything you submit will not harm your case.

Step 6: Review and Double-Check Your Application and Supporting Documentation

Before you submit your application, take some time to read through your application and make sure all the information is correct. The number one reason claims are denied is for missing or incorrect information. Here are some examples of what to look for:

- Did your doctor note your pain levels on your forms?

- Are all your medications related to your disability listed?

- Did you write down the correct mailing address for your doctor’s office?

Step 7: Copy and Organize

After you double-check your application, make a copy of everything. Create a file or use a binder to neatly store all of your documents related to your disability claim. This will include all the letters from the insurance company, letters from your employer, your medical records, and a list of medications. Keep everything organized and make a copy of everything before you submit it via certified mail. Sending your application by certified mail is a secure way of sending all these documents to your insurance company with the benefit of knowing they received them. Save that mailing receipt as well.

Step 8: Bring a Claim to the Plan Administrator

Now that you have obtained all the required documentation, the next step is to bring a claim to the plan administrator. Typically, an application for benefits consists of three parts:

- An application with detailed information from the claimant;

- Detailed information from the employer and

- The attending physician’s statement.

Failure to complete any of these forms can be fatal to a claim. In Mitchell v. Equitable Life Assurance Society of United States, the claimant was barred from filing suit for failing to supply the employee’s and physician’s statements.

There is also usually a requirement of a timely notice of claim and proof of loss or proof of claim consistent with your state’s insurance laws. However, a late notice will usually only bar a claim if there is prejudice to the plan’s insurer. The notice prejudice rule that applies to an insured ERISA plan was outlined in UNUM Life Insurance Company of America v. Ward.

Sending your application by certified mail is a secure way of sending all these documents to your insurance company with the benefit of knowing they received them. Save that mailing receipt as well.

The Determination Process for Long-Term Disability Claims

Most disability insurance claims are initially processed by either (a) the insurance company itself or (b) a claims administrator hired by the insurance company or employer to evaluate the disability claim. The “claimant” is the person who is requesting disability benefits.

The claims handler (a claim or insurance adjuster) verifies non-medical eligibility requirements, including employment verification, a job description, salary information, and more. The claims handler is also responsible for determining whether or not a claimant is disabled under the applicable long-term disability insurance policy.

RELATED VIDEO: Who Decides If I am Disabled in a Long-Term Disability Claim?

Usually, the insurance adjuster tries to obtain evidence from the claimant’s medical sources first. If that evidence is unavailable or insufficient to decide, the adjuster may arrange for an “independent medical examination” to obtain the additional information needed. The reports from these exams rarely favor the claimant.

The adjuster may also have the claimant’s medical records reviewed by a “peer review physician.” The peer-reviewed physician will then conclude that the claimant is not that impaired. After developing the evidence, the disability insurance company or claims administrator will allow the claimant to respond and then issue its disability determination.

RELATE VIDEO: What Will a Claims Administrator Do To Investigate Your LTD Claim?

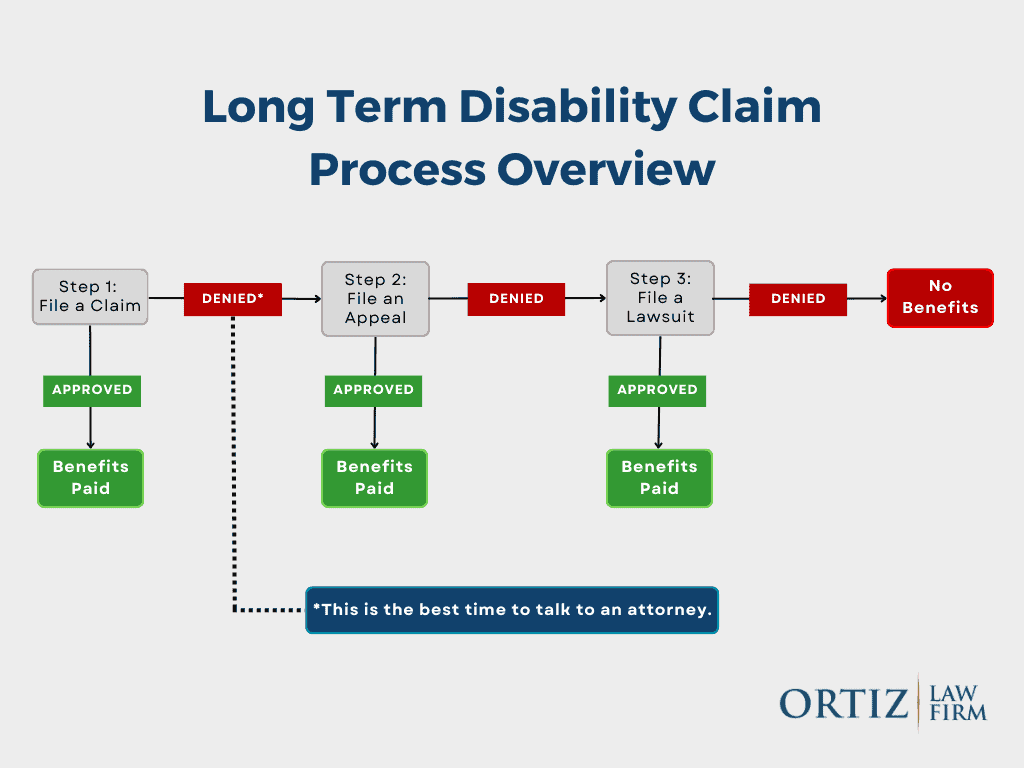

If the claims handler finds that the claimant is disabled, the insurance company completes any outstanding non-disability development, computes the benefit amount, and begins paying benefits. However, in many cases, the insurance company determines the claimant is not disabled. In that case, the insurance company issues a denial letter (or cutoff letter), and the file is administratively closed unless the claimant decides to appeal the determination.

What Do You Do If Your Long-Term Disability Claim Is Denied?

At this point, your next step is to exhaust all mandatory administrative appeals. Most long-term disability insurance policies/plans have an internal appeal process whereby you have the right to file an appeal of a denial directly with the insurance company. This right becomes a duty if you want to file a lawsuit. That’s because, in most cases, you cannot file a lawsuit unless you have gone through all mandatory appeals directly with the insurance company.

If you have a group policy, your claim is likely governed by the Employee Retirement Income Security Act of 1974 (“ERISA”). The key to an ERISA disability benefits claim is to follow all required steps in the administrative process. Claimants must “exhaust” their administrative remedies before filing a lawsuit. Failure to exhaust one’s administrative remedies may result in significant limitations on the court’s standard and scope of review in a lawsuit. This is why everything you do in the administrative claims process may determine whether you are ultimately successful in your claim should you have to go to court.

Most ERISA LTD policies have one of the following appeal structures: (1) two mandatory appeals, (2) one mandatory appeal, or (3) one mandatory and one “optional” appeal.

Determine If You Have A Group or Individual Policy

First, determine how you obtained the long-term disability policy. Which one of the following applies to you?

- You purchased an individual disability policy on your own directly from an insurance broker or representative;

- You are a government employee, and the government provides LTD coverage as a benefit of employment;

- You are a church employee, and the church provides LTD coverage as a benefit of employment or

- You have coverage as part of a group long-term disability plan with your employer.

ERISA governs most group disability insurance policies. With an individual disability insurance policy or if you are a church or government employee, you may not have to file any appeals directly with the insurance company before filing a lawsuit against the insurance company in state court for the wrongful denial or termination of benefits. This is why discussing your legal rights with an experienced LTD lawyer is important – to help you determine what you must do before filing a lawsuit.

Review Your Denial Letter

When a long-term disability claim is denied, or benefits are cut off, the plan administrator must send you a notice, either in writing or electronically, which includes a detailed explanation of why your claim was denied and a description of the appeal process.

In addition, the denial letter must include the plan rules, guidelines, or exclusions (such as a pre-existing condition exclusion) used in the decision or provide instructions on requesting a copy of these documents from the plan. The denial letter may also include a specific request for you to provide the plan with additional information in case you wish to appeal your denial.

Appeal Your Long-Term Disability Denial

Let’s assume that you are required to file an administrative appeal. A lot of work goes into filing an appeal, and your time to file the appeal for an LTD denial is limited. Thus, whether or not you hire an attorney to represent you, you should take immediate action and take the following steps in appealing a long-term disability denial.

- Step 1—Initial Appeal: Typically, you have 180 days from receiving the notice of denial or termination to submit your appeal.

- Step 2—Appeal Review: The insurance company typically has 90 days to decide on your appeal. About 50% of claimants are “put on claim” after the first appeal. This means the claim was approved (or reinstated), and benefits are payable.

- Step 3—Second Appeal (If Applicable): Most disability insurance policies (but not all) allow a second appeal. The process and timeline for a second appeal are similar to the first appeal.

- Step 4—Second Appeal Review (If Applicable): The process and timeline for the second appeal review are almost identical to the first.

- Step 5—Litigation: Many disability insurance claims go to federal or state court. The court process typically takes 1-2 years.

Request a Free Case Evaluation with a Long Term Disability Lawyer

Using an experienced disability attorney will help you protect yourself against the insurance company. Florida attorney Nick A. Ortiz is a skilled long-term disability attorney who is compassionate and dedicated to defending the rights of disabled individuals nationwide. We understand the struggle of living with a chronic disease, and we are here to help. We know your efforts are better spent on healing and getting better- not battling with your insurance company. For a free case evaluation with an experienced LTD attorney, contact us online or call (888) 321-8131. Most inquiries will receive a response within 24 hours of submission.