Table of Contents[Hide][Show]

Founded in 1906, Reliance Standard Life Insurance Company is a member of the Tokio Marine Group, a multinational insurance holding company. Reliance Standard is a major provider of employee benefit solutions, including short- and long-term disability (LTD) insurance. Unfortunately, disability claim denials are far more common than approvals.

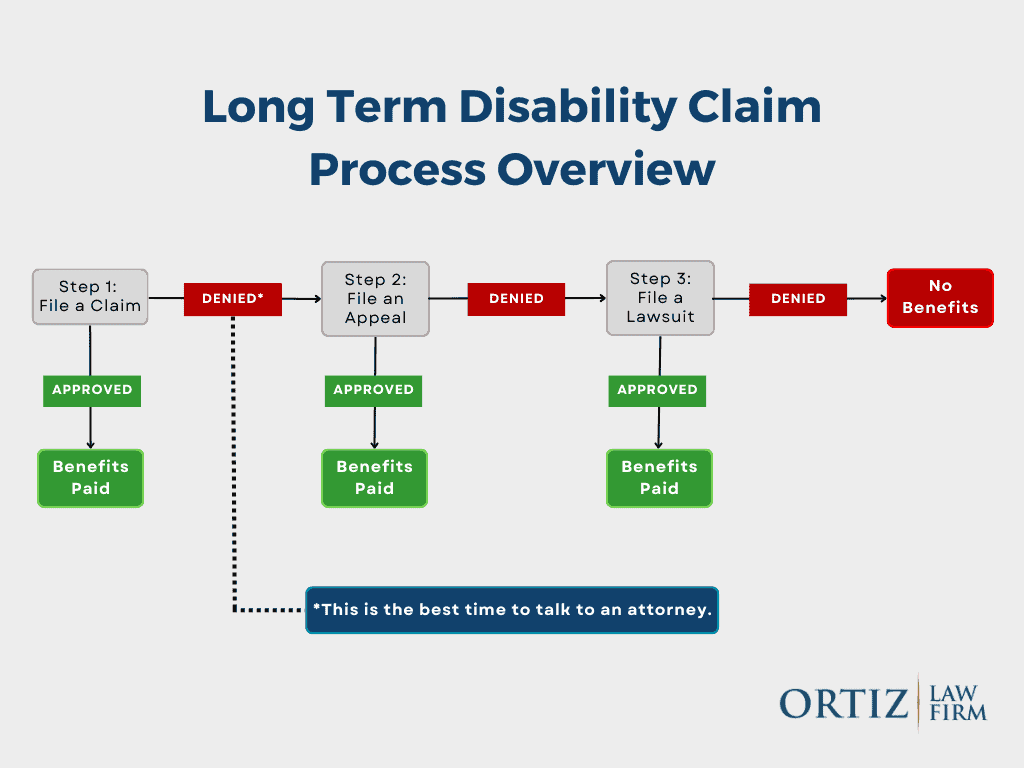

If Reliance Standard has denied your disability claim, contact us for a free case review. A disability lawyer from our firm can review your denial letter, explain your rights, and guide you through the administrative appeal process. If necessary, we can also help you file a lawsuit against Reliance Standard.

The Reliance Standard Disability Claim Review Process

Once you file a claim for Reliance Standard disability insurance benefits, a claims representative reviews your submission. During this process, Reliance Standard may request information about:

- Other disability claims you’ve filed, including SSDI

- Your activities of daily living

- Self-reported symptoms

Who Reviews Reliance Standard Disability Claims?

Initial claim reviews are typically conducted by in-house nurses employed by Reliance Standard. These reviewers evaluate your medical records, policy language, and supporting documentation to determine whether you meet the policy’s definition of disability.

If your claim is denied or terminated, Reliance Standard will issue a denial letter. These letters are often vague and conclusory, frequently stating only that you do not meet the policy’s definition of disability—without clearly identifying what evidence was missing or rejected. This lack of clarity makes the appeal process especially challenging.

Independent Medical Examinations (IME) and Functional Capacity Evaluations (FCE)

Reliance Standard may require you to attend an Independent Medical Examination (IME) or a Functional Capacity Evaluation (FCE) as part of its review.

- IME: A one-time medical evaluation performed by a physician hired and paid by the insurance company

- FCE: An assessment of physical capabilities, usually performed by a physical therapist

These exams are not conducted by your treating providers, and insurers often give them significant weight. Reliance Standard has also been known to conduct video surveillance before, during, and after these examinations, looking for activity they believe contradicts your reported limitations.

Claimants should approach these exams carefully and honestly, understanding that insurers may use isolated observations to justify a denial.

Why Reliance Standard Denies Disability Insurance Claims

Long-term disability claims are frequently denied unfairly. Reliance Standard has developed a reputation for aggressive claims handling, often forcing claimants into litigation.

Common Denial Tactics

“You Do Not Meet the Definition of Disability”

Reliance Standard commonly claims that a claimant does not meet the policy’s disability definition—even in ambiguous or medically complex cases. This is especially common with conditions like long COVID, chronic pain, and fatigue-related disorders.

Exclusions and Limitations

Reliance Standard often invokes:

- Pre-existing condition exclusions

- Mental health or self-reported symptom limitations

- 24-month caps on certain conditions

These provisions are frequently misapplied to justify early terminations.

A Change in the Definition of Disability

After 24 months of benefits, many policies shift from an own occupation standard to an any occupation standard. Reliance Standard frequently relies on this transition to terminate claims.

Vague Denial Letters

Denial letters often lack meaningful explanations, forcing claimants to guess what evidence is needed to appeal.

“Sandbagging” in Disability Insurance Claims

Reliance Standard has been known to withhold IME reports until after an appeal decision is issued. This tactic—commonly referred to as sandbagging—prevents claimants and their treating physicians from responding to unfavorable medical opinions before the record closes.

Although ERISA regulations now require insurers to disclose new evidence for claims filed after January 1, 2018, sandbagging still occurs, and claimants should watch out for this tactic.

How to Strengthen Your Disability Claim

Meet Your Policy’s Definition of Disability

Disability is defined by your insurance policy—not by statute. Many Reliance Standard policies require:

- Inability to perform your own occupation for the first 24 months

- Inability to perform any occupation thereafter

Limitations on mental or nervous disorder claims are common. Understanding your exact policy language is critical.

Submit Comprehensive Medical Evidence

Claims reviewers may selectively cite records to support denial. Protect yourself by submitting:

- Complete medical records

- Diagnostic testing (MRI, CT, etc.)

- Detailed physician opinions describing functional limitations

Be Prepared for Surveillance

Reliance Standard frequently uses private investigators and social media monitoring. A brief moment of activity on a “good day” does not mean you can work full time—but insurers often argue otherwise.

The Reliance Standard Appeals Process

If your claim is denied, the next step is an administrative appeal. During the appeal, Reliance Standard may rely on third-party file reviewers or require additional IMEs or FCEs.

Because courts generally cannot consider new evidence later, the appeal stage is your most important opportunity to build the administrative record.

How a Lawyer Can Help After a Denial

An experienced disability attorney can:

- Review your policy and determine whether ERISA applies

- Obtain and analyze your complete claim file

- Identify weaknesses in the insurer’s reasoning

- Gather additional medical and vocational evidence

- Prepare a comprehensive appeal

- File suit if benefits are still denied

We work on a contingency fee basis, meaning you pay nothing unless benefits are recovered.

ERISA Law and Reliance Standard Disability Claims

Most employer-sponsored disability plans are governed by ERISA, a federal law that strongly favors insurers.

Under ERISA:

- You usually have 180 days to appeal

- Courts review only the evidence submitted during the appeal

- Missing evidence can permanently harm your case

Recent ERISA rule changes now require insurers to disclose new evidence before issuing a final decision—but only for claims filed on or after January 1, 2018.

Lawsuits Against Reliance Standard

If your appeal is denied—or if you have an individual policy not governed by ERISA—you may be able to file a lawsuit. Reliance Standard has dedicated ERISA litigation teams, making early legal involvement critical.

How the Ortiz Law Firm Can Help

Filing for Disability Benefits

- If you are preparing to file a claim for long-term disability benefits, our Disability Insurance Claim Guide and Toolkit will guide you through the process and help you gather the information you need to support your claim.

- We also have a free eBook called “The Top Ten Mistakes That Will Destroy Your Long-Term Disability Claim“ that can help you avoid common mistakes that could destroy your claim.

Fighting Back Against a Claim Denial

When your insurance company refuses to pay your disability benefits, an experienced ERISA attorney like those at the Ortiz Law Firm can help you get the benefits you deserve. Many of the Reliance Standard appeals that we handle are result in the claim being reinstated. We also help those claimants who have exhausted their administrative appeals file lawsuits.

Get Help With Your Reliance Standard Disability Claim

If Reliance Standard is denying your long-term disability benefits, the Ortiz Law Firm can help. Disability attorney Nick Ortiz represents claimants nationwide.

Call us at (888) 321-8131 to request a free consultation today.